Rewarding Safe Drivers with

up to 30% car insurance rebate

annual car roadtax rebate

free personal accident insurance

free fuel and toll credit

weekly & monthly prizes

- 0

Total Drivers - 0

Safe Trips Logged

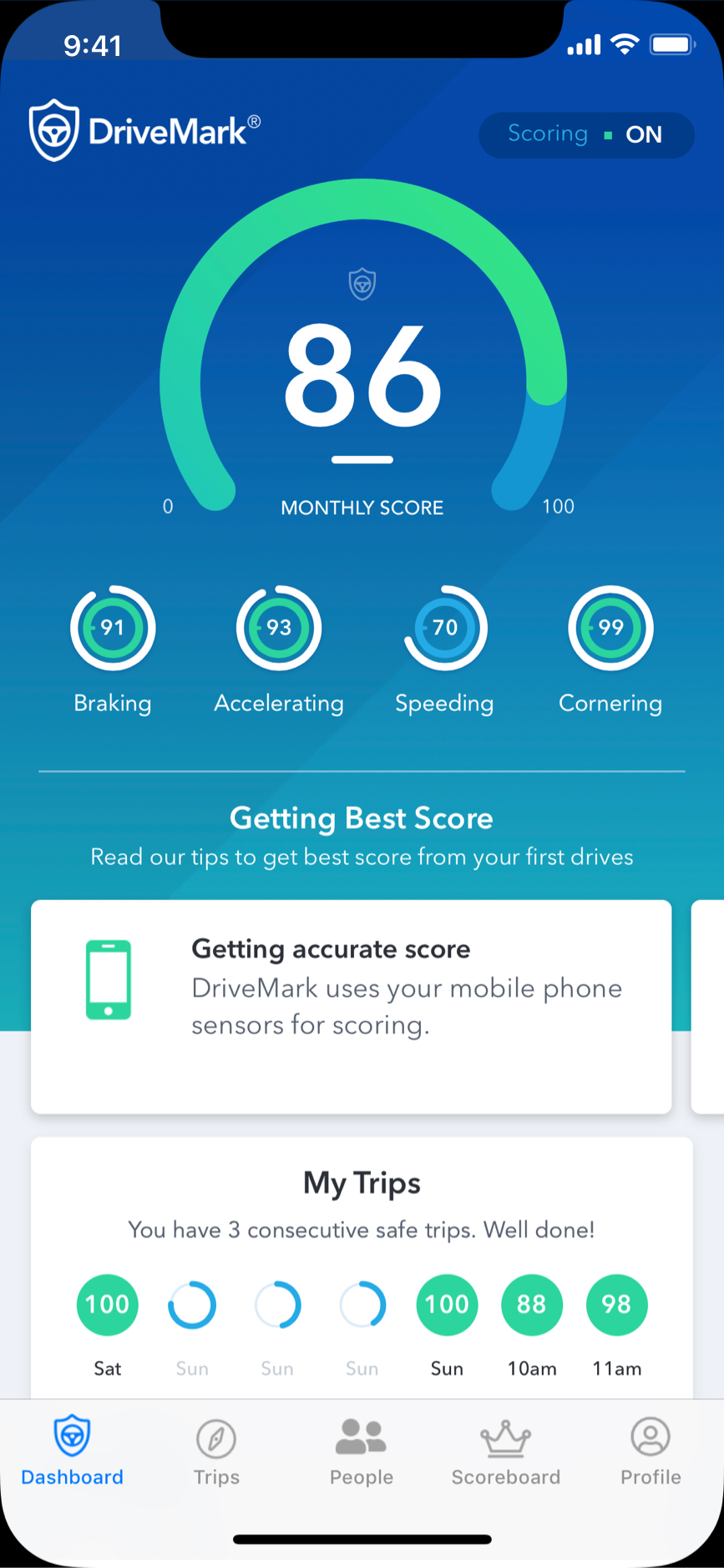

DriveMark® is an app that scores driving style and rewards safe driving. Join us!

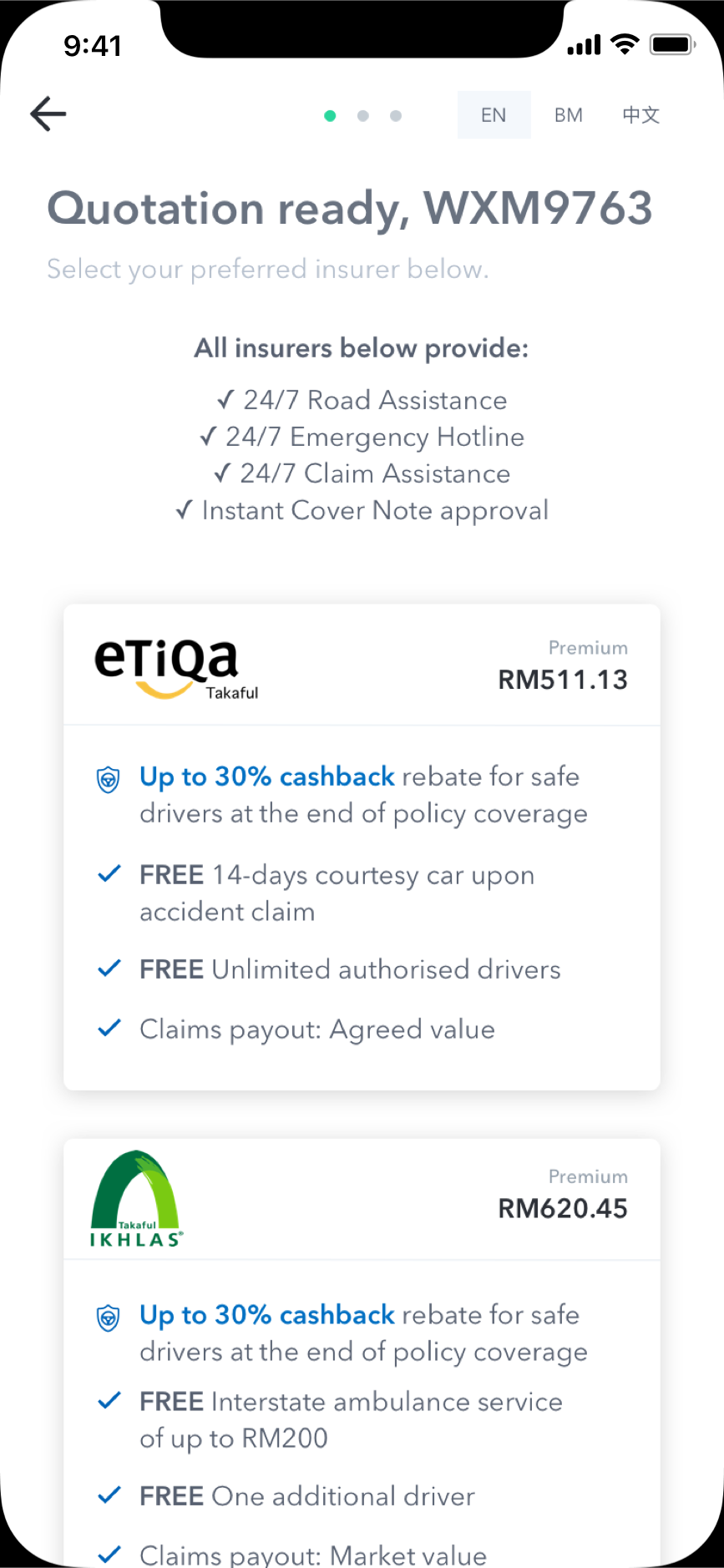

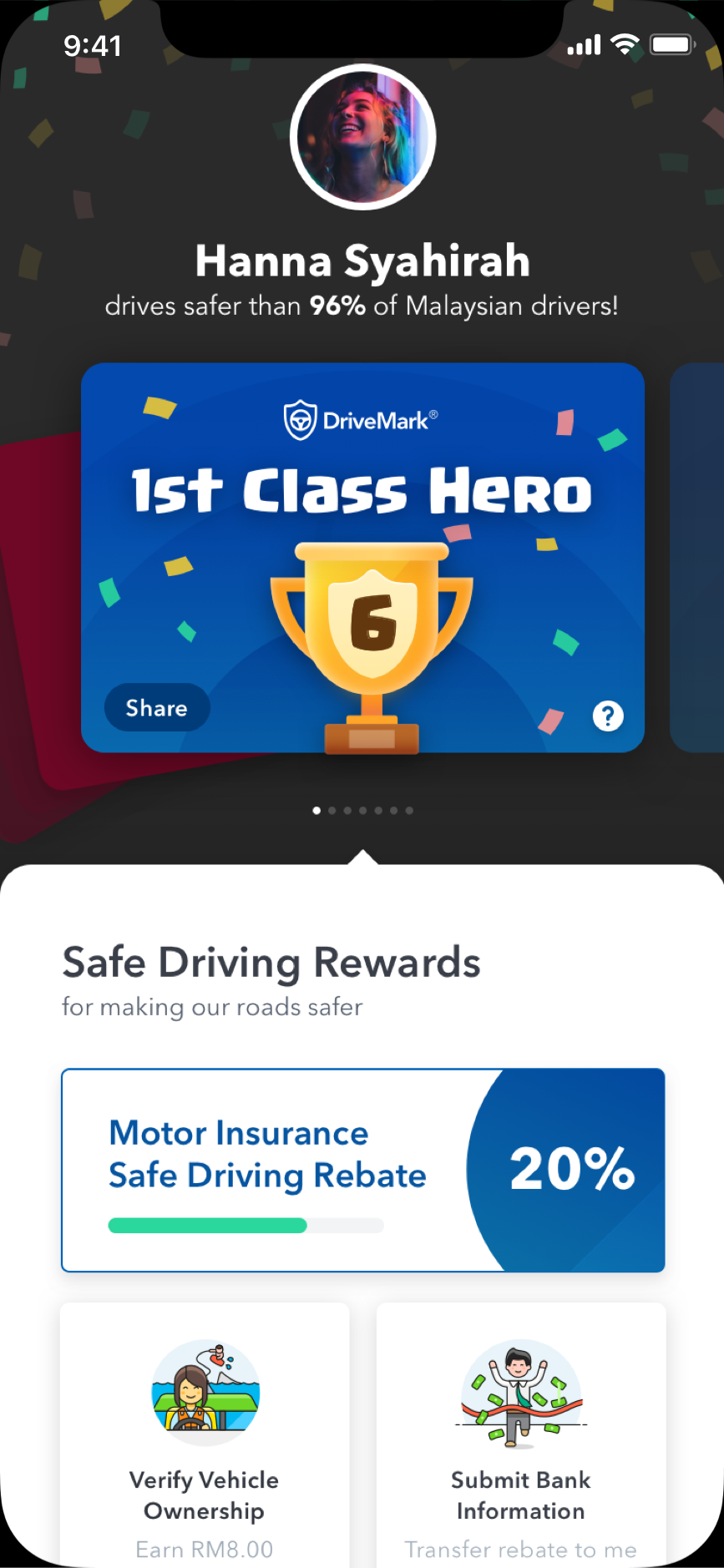

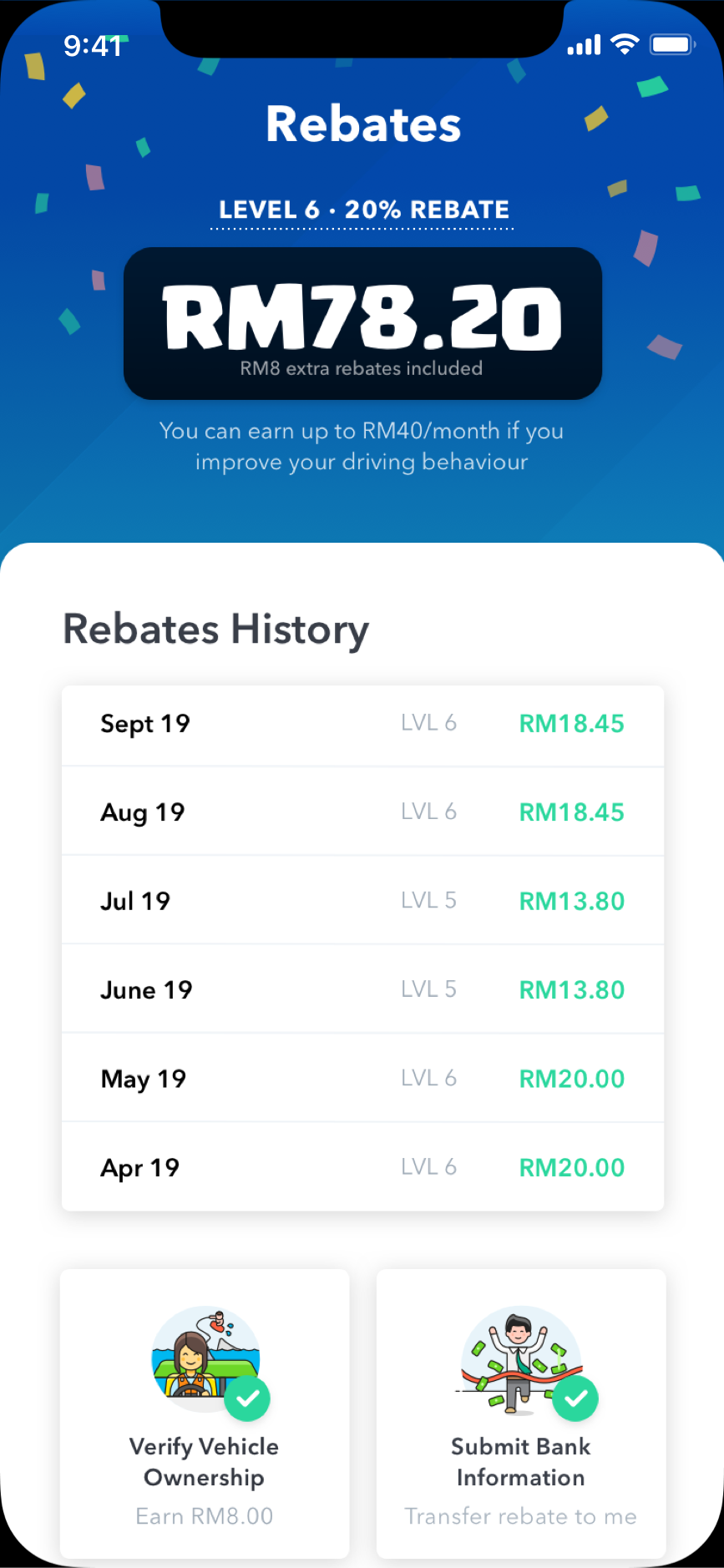

Up to 30% Car Insurance Rebate

for Safe Drivers

DriveMark® rewards Safe Drivers with monthly car insurance rebates, complimentary personal accident coverage, weekly prizes, free fuel and others. The safer you are on the road, the bigger rebates you get!

Renew Car Insurance

Renew car insurance and roadtax using the DriveMark app. Receive recommended coverage based on your driving style.

Get Rebates & Rewards

Get rewarded with car insurance and road tax rebates. Complimentary Personal Accident coverage and other monthly prizes.

DriveMark Motor Insurance and DriveMark Motor Takaful products are underwritten by Etiqa Takaful Berhad, Etiqa Insurance Berhad and Takaful Ikhlas Berhad. The products are governed by Bank Negara Malaysia, PIAM and MTA.

How It Works

Using DriveMark® is easy, just drive safe to win!

-

1

Download DriveMark® App

DriveMark® app is free and highly rated by drivers like you.

-

2

Renew Car Insurance

Renew directly within the app. Fast and easy!

-

3

Level Up by driving safely

Level Up quickly to get more cashback every month.

-

4

Get Cashback every month

Win cashback & giveaways by driving safely.

Download DriveMark® App

DriveMark® app is free and highly rated by drivers like you.

Renew Car Insurance

Renew directly within the app. Fast and easy!

Level Up by driving safely

Level Up quickly to get more cashback every month.

Get Cashback every month

Win cashback & giveaways by driving safely.

Every Safe Miles Driven Rewards You!

DriveMark is a community that rewards safe driving. Join regular challenges to win great rewards while encouraging friends and family to be safer on the road.

Challenges & RewardsWhat Our Community Says…

Very good apps. Helps us as a driver to drive safely and educate people to show a good example to others. Track speed accurately and they keeps contest and news up to date. Have an automatically scoring and it will easethe people to use it The apps have very good esign and user-friendly.

Things are getting better. I would recommend this apps to my friends. Once I install this apps on my iPhone, it constantly reminds me to drive carefully from time to time. When I drove my car faster, once I ended my journey, I opened the apps and check my score. When I got low marks, it made me sad and I will drive better next. Thank you for creating this amazing apps!

Great app track my driving behaviour. Is good to be a safe driver not for us alone but other drivers on the road.

Loved the ecosystem, and the free monthly insurance coverage is a positive reward to incentivise good driving.

Safe Driving, Saves Lives! DriveMark is the best mobile telematics app that helps to keep tabs on our motoring. It is interesting to review the trip history and track how our driving behavior might have changed over time. This app also gives rewards for maintaining good scores in driving.

This is a good app for drivers to practice good driving as well as getting the insurance covers up to RM10k if you keep your marks at least 80%.