It has always been our mission to reward safe drivers. We believe that road safety is the responsibility of everyone and drivers should be rewarded for making Malaysian roads safer.

We are thankful for your support since 2017. Your support has enabled DriveMark to be voted 4.8 stars on Google Play / 4.7 stars on Apple AppStore. With this strong show of support from the safe driving community, DriveMark managed to convince insurance partners to come up with exclusive Safe Driving Rebate for drivers like you.

🏆 Fairer car insurance for safe drivers. You deserve it.

DriveMark is excited to announce the pilot of 🛡️ DriveMark Safe Driving Rebate program that will reward safe drivers with up to 30% car insurance rebate.

For example, if you pay RM1000 to renew car insurance with DriveMark, now you can earn cash back of up to RM300 cash for driving safe! That’s huge 💰.

This rebate is credited every month into your DriveMark account. At the end of the policy period, the total rebates earned are remitted into your bank account as cash! Awesome isn’t it?

How will the program benefit you?

This safe driving rebate program allows you to get cashback by collecting monthly car insurance cashback/rebate for being a safe driver. You still enjoy exactly the same coverage as regular insurance/takaful products, and now with DriveMark, you benefit from additional cashback for driving safe.

In simple terms:

Previously: You pay RM1000 (example) to renew car insurance and receive nothing back at the end of policy coverage period.

Now with DriveMark: You can now pay the same RM1000 to renew your car insurance, drive safe, and get up to RM300 cashback at the end of policy coverage period 💃.

Does this affect my NCD (Non-claim Discount)?

This program does not affect your NCD. In fact, this is an additional rebate which means you get more savings for driving safe!

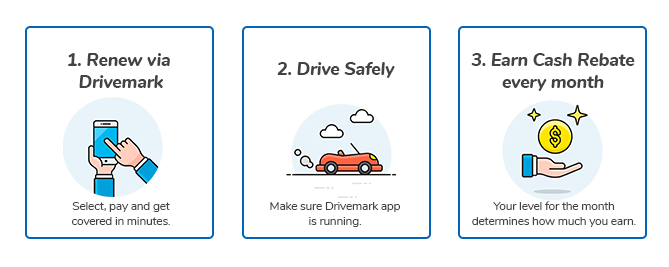

How do I start earning Safe Driving Rebates?

You can start earning the rebate by renewing car insurance with DriveMark. This rebate is only available for policies renewed using DriveMark.

💎 Which insurers & Takaful players are available within DriveMark?

This program is supported by 3 insurers:

- Etiqa Takaful Berhad

- Etiqa Insurance Berhad

- Takaful Ikhlas Berhad

How is the car insurance rebate calculated?

The Safe Driving rebate is calculated every month based on DriveMark Level you have reached for the month.

The total rebate earned for the policy period is accrued based on monthly rebate earned in the past 12 months. Realistically, you may earn more and less in subsequent months, all depending on your driving style & Level reached for the particular month.

Level 1 to Level 3: 0% Safe Driving rebate (a new user can easily graduate to Level 4 within 2 months)

Level 4: 5% Safe Driving rebate

Level 5: 15% Safe Driving rebate

Level 6: 20% Safe Driving rebate

Level 7: 30% safe Driving rebate

–

As an example: If you are at Level 6 for this particular month, and you have paid RM1000 for car insurance renewal, your rebate for the month is:

RM1000 x 20% ÷ 12 months = RM16.67

Another example: If you constantly stay at Level 5 for the next 12 months, your total annual rebate for driving safe consistently would be:

RM1000 x 20% = RM200.00

I want that car insurance rebate! How do I start renewing car insurance with DriveMark?

Step 1: Click the ‘Renew Insurance’ button located at the top right of this page.

Step 2: Fill up contact info and vehicle ownership info for processing.

Step 3: Compare coverages as displayed.

Step 4: Choose your most preferred car insurance coverage.

Step 5: You can opt for additional coverages (windscreen, flood, etc )

Step 6: Purchase your selected coverage.

Step 7: Receive your cover note via email within 24 hours.

Easy kan? 👌🏻

BUT WAIT……..

Renew your road tax with DriveMark!

Yes, you can also renew your road tax with us. 📲

After renewing your car insurance, you will be offered options to renew your road tax.

It’s a fairly simple process that takes little time to complete.

Thank you for making our roads safer!