KUALA LUMPUR: Usage-based Insurance (UBI) is a platform that is no longer foreign in this “Internet of Things” (IoT) world.

However, not many in Malaysia are familiar with this mechanism to give value to vehicle insurance, which helps to create safer roads and save more lives.

UBI will allow insurance companies to acquire driving behavior data which then will help them curate better insurance programmes.

Today, three insurance companies Allianz Malaysia Bhd, Etiqa Insurance Bhd and Etiqa Takaful Bhd have paved its way to boost adoption of UBI in Malaysia.

The three insurers signed a Memoranda of Understanding (MoU) with a local start-up, Pixelated Sdn Bhd (KATSANA) which will allow insurers to develop UBI products for their customers.

In addition, the parties involved will work together with KATSANA to improve its newly launched DriveMark telematics app as means to collect driving behavior data.

KATSANA managing director and co-founder, Syed Ahmad Fuqaha Syed Agil, said the collaboration is important for all parties involved as it helps to promote a progressive and transparent UBI approach.

“We work together to analyse the data, to understand what’s the actual risk of drivers in Malaysia.

“And we use this data to help them become safer drivers on the road and offer them rewards for good behaviour.

“We hope this is going to be a social movement where KATSANA and drivemark, together with our insurance partner in Axiata become the catalyst for safer driving in Malaysia,” he said.

Article from: Astro Awani

Similar Articles

Car Accident Detection and Emergency Alert using DriveMark mobile app

When DriveMark was launched back in 2017, it carried our aspiration to make the roads safer for everyone. From then on, we introduced several features to encourage drivers to be...

DriveMark now lets you renew Car Insurance

We know that it is super leceh and pening kepala to renew car insurance. Last year your parents renew for you, this year forget how already [facepalm]. Introducing Car Insurance...

Prudent Car Drivers May Be Rewarded With Car Insurance Premium Discounts

(Image: The Coverage) Written by Olivia Song for RinggitPlus, 8th February 2019 The Transport Ministry plans to start rewarding discounts on car insurance premiums to motorists who do not have summonses...

⭐⭐5 Popular Road Scams in Malaysia: Ways To Avoid Them⭐⭐

For every Malaysian, you may have had family members and/or friends who have faced cases of road scams resulting in loss of valuables, injuries, or also near-death experience. In order...

DriveMark December Hero

Muhammad Hafizi What does it take to be a super hero? Should a hero self sacrifice so that Thanos won’t get the infinity stone? OK, we love selfless hero but...

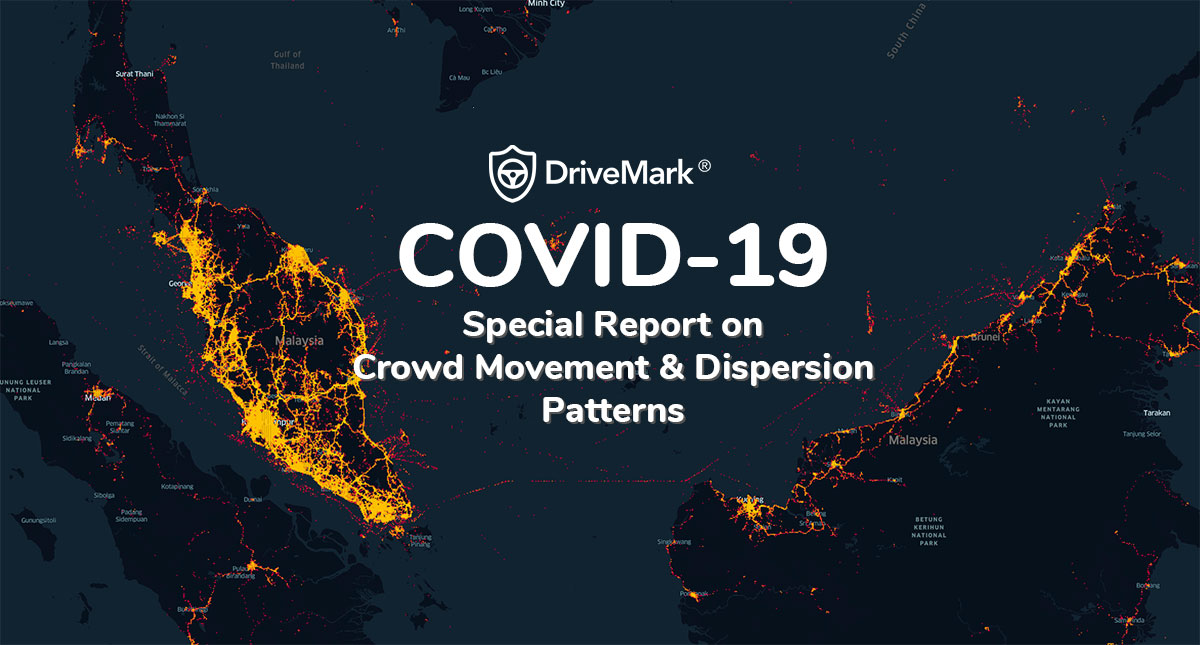

Crowd movement pattern during Covid19 crisis

During this period of Restricted Movement Order, DriveMark has a unique opportunity to understand how well Malaysians comply to the #StayAtHome directive. You see, DriveMark is app that collects driver...